A Look into the Customer Payment Insights Feature in Dynamics 365 Finance

Forecasting when customers will settle their invoices can be a tricky task. This uncertainty leads to imprecise cash flow forecasts, delayed collection processes, and the release of orders to customers who might fail to meet their payment obligations. To tackle these challenges, Microsoft Dynamics 365 Finance is set to launch the Customer Payment Insights feature. It aims to help businesses foresee when an invoice will be settled, thereby facilitating the creation of collection strategies that enhance the likelihood of timely payment.

Keep reading this blog for an exclusive sneak peek at this new tool. This post outlines the capabilities of payment insights to better grasp individual customer payment habits.

Predictive Analysis

Payment predictions will empower businesses to refine their operations. They can more easily pinpoint invoices that may be paid late and implement measures to enhance the chances of on-time payment.

Through a machine-learning model utilizing historical data on invoices, payments, and customers, Customer Payment Insights (Preview) forecasts when a payment on an outstanding invoice will likely occur.

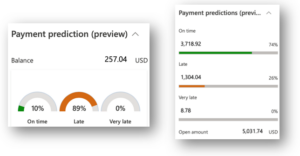

For each pending invoice, this tool predicts three payment scenarios:

- Probability of payment being made on time.

- Probability of payment being made late.

- Probability of payment being made very late.

The tool also offers a consolidated view of expected payments, helping organizations gauge the total amount they can anticipate from a customer in one of three categories: On Time, Late, or Very Late.

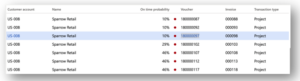

Additionally, invoices are marked with a probability of on-time payment. If this likelihood falls below 50%, a red circle will highlight the invoices, signaling that they may need collection intervention.

Customer Payment Insights (Preview) also supplies background information to clarify the prediction, identifying key factors that affect the forecast, the current customer relationship status, and past payment behaviors. Collections have often been a reactive task in many businesses, commencing only when invoices fall due.

With this new feature, organizations can act ahead of time about collections. They no longer need to await due dates to begin collections. Rather, the predictive capability allows them to assess if earlier collection efforts will enhance the chances of on-time payment. This prediction also equips businesses with the rationale needed to initiate early collection.

Deployment Method

Creating and launching an AI solution can be a complex process. It requires a collaborative effort between data scientists, experts, and engineers, often over an extended period, to conceptualize, create, launch, and maintain a functional AI tool. We’ve streamlined the process by offering AI solutions in Finance that are founded on Microsoft AI Builder. A user can deploy the AI solution with just one click and start enjoying the advantages of intelligent forecasts. If there’s dissatisfaction with prediction accuracy, a power user can modify the fields used for predictions with a single click, retrain, and publish the adjustments. The newly trained model will then be automatically employed for future predictions in Finance.

Next Steps:

If you are interested in learning more about the customer payment insights feature in Dynamics 365 Finance in Microsoft Dynamics 365 for Finance, contact us here to find out how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8817.