How to Calculate Overhead Costs in Microsoft Dynamics 365 Supply Chain Management

Every business grapples with expenses that don’t tie directly to a specific activity, product, or service. These are called overhead costs. Capturing and analyzing these costs is an indispensable component of financial planning. They indirectly support the profit-generating activities. Expenses may include office rent, utility bills, and the salaries of management. When you can effectively track and allocate such overheads, you pave the way for a holistic view of your company’s fiscal health. It helps in shaping decisions, tweaking pricing models, and setting budgets. Moreover, a granular view of overheads can spotlight areas ripe for enhanced operational efficiency. This is where the nuances of overhead cost accounting come into play, offering actionable insights to strategize, regulate finances, and pave the way for future aspirations. Here, we delve into the intricacies of assessing and assigning overhead costs, focusing on the functionalities of Microsoft Dynamics 365 Supply Chain Management.

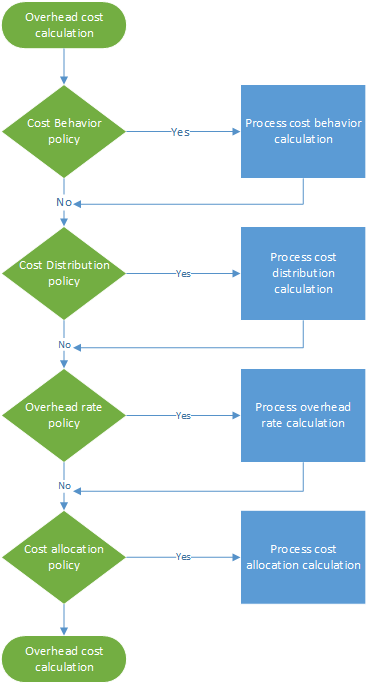

Decoding the Overhead Cost Calculation Process

When you perform an overhead calculation, you ensure that all cost accounting policies are applied correctly. If there are changes to these policies or if errors pop up, you can re-run this calculation multiple times within the same fiscal period. Every execution is cataloged with a distinct version ID, enabling side-by-side comparisons. The generated cost entries are timestamped, coinciding with the fiscal period’s closing date. The unique ID is a blend of:

- Calculation version

- Timestamp

- Cost accounting ledger

- Fiscal year and period

The overhead calculation is independent of its version. This means you can calculate the ‘Budget’ version even before diving into the ‘Actual’ version. The calculation spans four key steps, each yielding a journal header. Policies and guidelines mold each journal entry, producing cost entries and ensuring end-to-end traceability.

Dissecting the Overhead Costs: The Case of Electricity

In traditional financial accounting, certain costs, like electricity, are lumped together, making managerial insights vague. For precise insights in cost accounting, it’s essential to distribute costs across organizational structures based on exact consumption records or equitable evaluations.

Steps in Detail:

- Cost Behavior Analysis: As cost data is imported, it’s usually tagged as ‘Unclassified’ within cost accounting. However, through policy rules, these can be earmarked as either ‘Fixed’ or ‘Variable’.

- Cost Dispersion Calculation: This step redistributes the cost from a specific cost object to multiple others, using a pertinent allocation base.

- Overhead Rate Analysis: This stage determines the charge to one or several specific cost objects, grounded on a pre-defined cost rate and the magnitude of the designated allocation base.

- Cost Allocation Computation: The cost object’s balance is distributed to other objects using an allocation base. The software smartly sequences these allocations, accounting for mutual auxiliary cost services.

Next Steps

If you are interested in learning more about how to calculate overhead costs with Microsoft Dynamics 365 for Supply Chain Management, contact us here to find out how we can help you grow your business. You can also email us at info@loganconsulting.com or call (312) 345-8817.