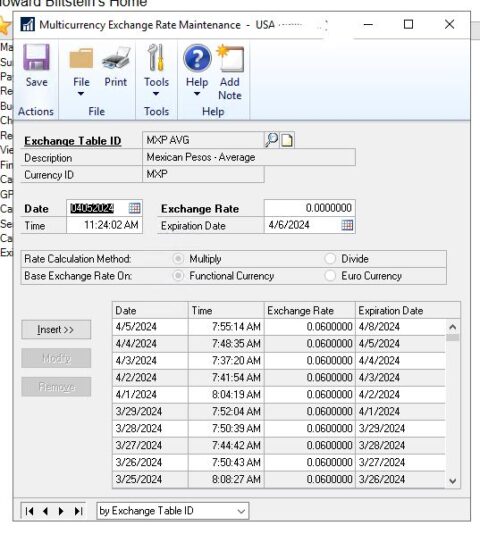

::Sorry, sorry, sorry this is getting long and convoluted. And I am not an accountant so if none of this makes sense, my apologies. We are working through getting the batches posted. But that leaves us with another issue regarding applying payment to these invoices. All our MXP invoices are paid outside of GP, so Accounting does Manual Payments, but they want to do this with US dollars which GP doesn’t like. But they come back to me saying they need this and this is the reason…”Our bank account is all US cash so the GL account is listed in USD. Our concern is if we apply payment in MXP, GP will convert MXP to USD using a different exchange rate than our bank. This will cause discrepancies with what our bank statement shows was paid in USD and what GP shows. Therefore, we will not be able to reconcile the US bank.”

I did mention a recommendation by Richard Wheeler saying…” You will need a checkbook in the vendor’s currency and need to pay them using this same checkbook. You can, however, point the checkbook back to the same cash account as your regular checking account, keeping all the transactions automatically in one GL for reconciliation.”

But….Accounting came back with this…<b style=”background-color: var(–bb-content-background-color); font-family: inherit; color: var(–bb-body-text-color);”>AP uploads invoice in MXP, but GP posts the USD equivalent based on GP’s exchange rate table.

Invoice 14,213.48 MXP

GP Equivalent 824.38 USD

Treasury pays invoice based on MXP, but the USD equivalent based on banks rate actually comes out of the bank.

Payment 14,213.48 MXP

Bank Equivalent 820.67 USD

We need GP to be able to post $820.67 USD to the cash GL account, GP should not post $824.38 USD to cash GL account.

<ul type=”disc”>

If 824.38 needs to be posted to clear the invoice’s

USD equivalent amount then 820.67 still needs to go to GL cash account and

3.71 to the currency exchange loss/(gain) GL account.