Fixed Asset Module – Best Practices & setup

-

Fixed Asset Module – Best Practices & setup

Posted by Brad-Reeves on April 19, 2017 at 5:25 pm-

We are users of Microsoft Dynamics AX 2012 and just imported our assets into the Fixed Assets module. Just curious if anyone has any best practices for fixed asset management and setup as well as lessons learned. One area of particular interest is ideas that maximize the usefulness of canned reports in the module.

——————————

Brad Reeves

Supervisor – Financial Accounting

Bill And Hillary Clinton National Airport

Little Rock AR

—————————— -

Hi Brad,

Here are some best practices for setting up/using fixed assets in AX 2012.

1. Typically, companies set up one value model per fixed asset group. So, for example the value model ‘MACH’ would only be used for the fixed asset group ‘Machines’. This helps to organize your assets and also to distinguish them apart when running reports. Each value model/ fixed asset group then has it’s own ledger account so you have better insight into your trial balance.

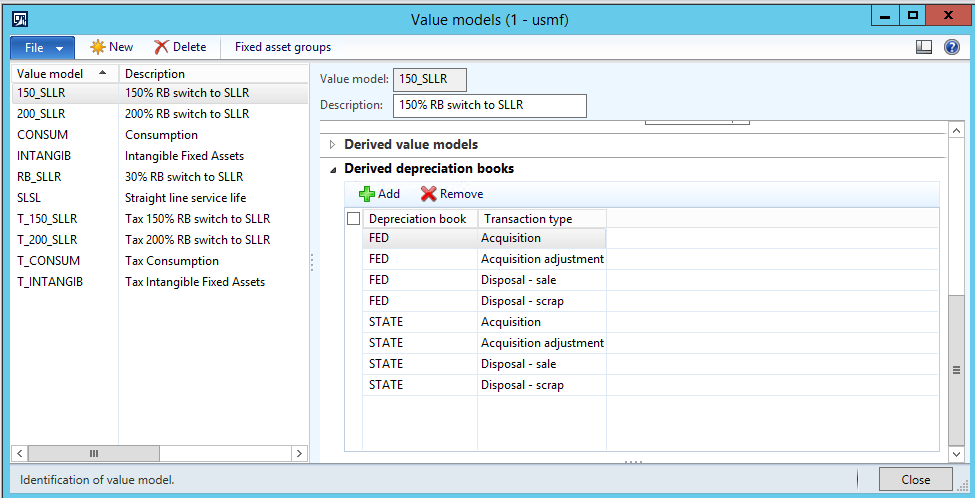

2. If you want to track the tax depreciation of an asset, I would suggest using the depreciation books in combination with the derived depreciation books functionality. The derived depreciation books is a nice feature as each transaction you make (under your normal value model) it also automatically makes that same transaction in the depreciation books. The main difference between value models and depreciation books is that transactions with value models post to the general ledger while depreciation books are purely informational and have no effect on your general ledger. Please note, you can also use derived value models as well.

3. A piece of advice is to take time to plan out your posting profile for each value model and test every and any situation you can imagine. The disposal sale/scrap posting parameters are very complex and require a lot of planning and testing.4. The best report, in my opinion, is the fixed asset balances report. This shows you the acquisition cost, depreciation expense, and the NBV among other things. It also allows you to summarize totals of these amounts into each fixed group, which is helpful when reconciling your fixed asset subledger to your general ledger.

Please let me know if you need any additional help or guidance and feel free to reach out as necessary.

——————————

Chris Rusing

Logan Consulting

Chicago IL

——————————

——————————————- -

Kristal Baird

MemberApril 20, 2017 at 4:16 PM

We just went live on the FA module at the beginning of 2017 with 72,000 assets. Both of our FA managers would be glad to chat with you.

Here are their email addresses if you would like to reach out to them directly & set up a call. They have worked through numerous roadblocks & would be glad to share their experience.

Jennifer Ehard – Senior Managner of Fixed Assets & Leasing

jennifer.erhard@texasroadhouse.comShannon Masterson – Manager of Fixed Assets

shannon.masterson@texasroadhouse.comThanks!

——————————

Kristal Baird

Senior Manager of Accounting Systems

Texas Roadhouse

Louisville KY

——————————

——————————————- -

Good morning FA users!

Did any of you have any issues loading the initial data from your old systems?

Thanks,

Sam

——————————

Sam Clark

Business Systems Analyst

Team Technologies

Morristown TN

——————————

——————————————- -

Sam,

XTRA converted its assets in 2013 for version AX 2012 R1 and there were numerous issues when trying to initially load the data into DAX FA. Our biggest challenge was narrowing down our conversion rules from our old system to the new system to have the assets depreciate correctly for both the Financial and tax depreciation books. It took several iterations to verify our scenarios especially understanding how DAX will depreciate the assets once converted. We also had issues once the assets were converted and transactions began on those converted assets. If you would like to talk more, you can contact me at kmsorrentino@xtra.com.——————————

Karen Sorrentino

Applications Manager

XTRA Lease

St. Louis MO

——————————

——————————————- -

Thanks Karen!

I sent you an email.

Sam——————————

Sam Clark

Business Systems Analyst

Team Technologies

Morristown TN

——————————

——————————————- -

Barr Snyderwine

MemberApril 26, 2017 at 8:45 AM

We also had issues setting the depr to date properly so the asset would have total value, accumulated depreciation, net value, AND toe to the gl

we decided to have a consultant configure and tell us how to upload, that saved us boatloads of time trying to figure it out

they did not do everything just the tasks we would have taken too long to learn and test——————————

Barr Snyderwine

Hargrove, Inc.

Lanham MD

——————————

——————————————- -

Jimmy Stewart

MemberApril 20, 2017 at 12:14 PM

Hi Brad,We have been using the Fixed Asset module in AX 2012 R2/CU7 for about 18 months. We currently manage over 90K assets in AX Fixed Assets.

Before going live, we customized the Fixed Asset module by doubling the number of sort fields to enable us to capture additional information for each asset. We’re currently working on a customization to allow a more efficient process to split assets.

In our experience, many of the out of the box reports in Fixed Assets are missing key data fields. We overcame this by utilizing Atlas to extract the information we need. But, with 90K+ assets and ever-increasing internal control requirements, we’re heading down another path. We’re stepping through the out of the box reports and modifying them to include the information we need. So far, we’ve revised the Disposals report and the Fixed Asset Listing report to include additional fields.

Added following fields to Disposal Report: Placed-in-Service Date, Acquisition Cost, Accumulated Depreciation and a key Sort Field.

Added following fields to Fixed Asset Listing: Acquisition Date, Placed-in-Service Date, Acquisition Price, and Accumulated Depreciation.

——————————

Jimmy Stewart

AXUG Virginia Chapter Leader

http://www.axug.com/richmondDirector, Financial Operations

Shentel

Edinburg, VA

——————————

——————————————- -

Christopher Esposito

MemberMay 9, 2017 at 2:10 PM

Hi All,Please see attached work instructions around Fixed Asset setup in Microsoft Dynamics AX 2012 RTM.

I believe the community will find these very useful.

Best Regards,

Christopher Esposito

——————————

Christopher Esposito

Hamamatsu Corporation

Bridgewater NJ

——————————

——————————————-

Brad-Reeves replied 8 years, 4 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Fixed Asset Module – Best Practices & setup’ is closed to new replies.