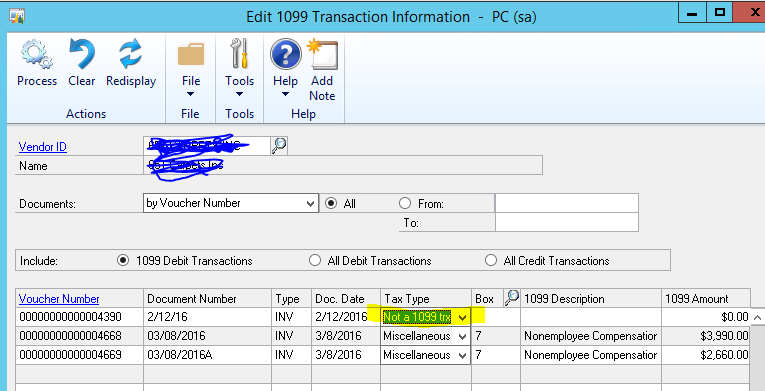

What is the proper way to void a prior year vendor check that previously generated a 1099

-

What is the proper way to void a prior year vendor check that previously generated a 1099

Sorry, there were no replies found.

The discussion ‘What is the proper way to void a prior year vendor check that previously generated a 1099’ is closed to new replies.