Sales Tax on SOP

-

Sales Tax on SOP

Posted by Jeff Roe on February 12, 2020 at 10:32 pm-

I have a new company setup but for some reason when I enter a SOP transaction I don’t see the header or lines populating with a Sales Tax schedule of is tax calculated.

I have validated that the appropriate schedules and jurisdiction exist in the TX00101, TX00102, TX00201 and TX00202.

The customer master and addresses also have the correct tax schedules.

Is there a setting somewhere that I’ve missed or where else should I lookz/Thanks

——————————

Jeff Roe

Kele Inc

Bartlett TN

—————————— -

Hi Jeff.

The sales tax in SOP is a combination of sources:

– On the company setup, the sales tax schedule there.

– The customer BILL TO address tax schedule

– The item sales tax schedule

– The site address sales tax scheduleHope it helps!

——————————

Thomas Garcia

ICON Business Consulting, LLC | Miami FL

ICON, SRL | Santiago, Dominican Republic

954-804-2140

MiamiMiamiMiamiMiamiMiami

——————————

——————————————- -

I should add that the following optional setup in the Setup > Company > Options window may affect tax schedule selection as well:

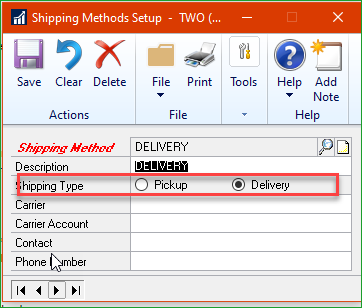

Use Shipping Method when Selecting Default Tax Schedule

Specify whether or not you want to use the shipping method when selecting the default tax schedule on a transaction. Microsoft Dynamics GP calculates taxes at the point of exchange, using the shipping method assigned to a transaction to determine the point of exchange. The shipping method will determine which tax schedule appears as a default schedule for the transaction. If you decided not to use the shipping method to determine the default tax schedule, the tax schedule assigned in the Vendor Maintenance window or the tax schedule assigned in the Customer Maintenance window will be the default tax schedule.

TG

——————————

Thomas Garcia

ICON Business Consulting, LLC | Miami FL

ICON, SRL | Santiago, Dominican Republic

954-804-2140

MiamiMiamiMiamiMiamiMiami

——————————

——————————————- -

In SOP and other transactions, taxes are calculated based on where the merch is being delivered to or picked up at, so you may be missing a shippingmethod on the line items of the SOP transaction.

It relies on knowing exactly WHERE to tax. If a customer is picking up the item it will be taxed at your warehouse/office locations tax schedule. If you are delivering it it will be taxed at the deliver address.

This is why Shipping Methods have only ONE important field, ?whether it is Pickup or Delivery!

-

That appears to have been my issue.

The default Ship Method for most customers is FedEx Ground and at some point it was updated from delivery to pickup.

Once it was set back to delivery, the Sales Tax began calculating as desired.

Always great to have other sets of eyes on a task, sometimes we can’t see the forest for the trees!

Thanks all

——————————

Jeff Roe

Kele Inc

Bartlett TN

——————————

——————————————-

Jeff Roe replied 5 years, 6 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Sales Tax on SOP’ is closed to new replies.