Sales Invoicing Scenario

-

Sales Invoicing Scenario

Posted by Unknown Member on February 27, 2017 at 3:40 pm-

Good Afternoon,

I have a client who has several GP Companies (entities) and they do transfers from the Main company (Company A) to the smaller LLC Companies (company B, C and D). Company A will transfer funds to Company B, C, and D several times during the month and then Invoice Company B, C, and D for the amount that was transferred. Company B, C, and D will create an AP Invoice to pay Company A back for the transfers.

We are pulling in the Transfers from the Bank Accounts (Transfer Withdrawal and Transfer Deposit) in through Smart Connect. I was originally pulling these in as IAJ and DAJ entries and hitting cash and due to/due from accounts.

The client has changed their process and is now wanting to enter these transactions straight as Sales and AP entries. My question is how to record the Invoice, in Company A, to Customer B, C, or D, and the Transfer withdrawal (out of the Checkbook from Company A) in the same entry? The three accounts that should be hit are Cash, AR, Sales. A RETURN in Sales will allow me to record the withdrawal but not show properly in the AR module. It should be a sales invoice that will be paid at a later date.

And then on the Company B how to enter the Payment (transfer deposit) and record it as a Payable that needs to be paid at a later date to Company A.Are you as confused as I am?????? Please help.

Thank you in advance.

——————————

Tammy Chavez

Senior Software Consultant

LightHouse Business Information Solutions, LLC.

Albuquerque NM

—————————— -

Leslie Vail

MemberFebruary 27, 2017 at 7:35 PM

Hi Tammy,

Presuming that Company A initiates the transaction, a SOP Document would be entered as a sale to company B (or whichever). Company B would use SmartConnect to import an AP transaction using the SOP WORK table of Company A as the source. Company B would either create a payment transaction to Company A, or they could create their AP transaction as already paid and then Company A could import and apply the receipt.

Kind regards,

Leslie——————————

Leslie Vail

Accounting Systems Consulting, Inc.

Dallas TX

——————————

——————————————- -

Hi Leslie,

Thank you for your reply. I didn’t know about the table import. This is very helpful. However, my dilemma is how do I record the deposit to Company B at the same time as I create the AP transaction in GP and hit the AP account/Cash account and Expense account at the same time without overstating the AP account.

Here is the entry as I see it now:

Bank Transaction to record Deposit of Funds into Company B from Company A:

Create IAJ to Checkbook for $1000.00

Debit – Cash 10000-400-0000 $1000.00

Credit – Accounts Payable 20000-400-0000 ($1000.00)Accounts Payable Invoice to record Payment to due Company A from Company B:

Create AP Invoice to Vendor Company A for $1000.00

Debit – Expense 54000-400-0000 $1000.00

Credit – Accounts Payable 20000-400-0000 ($1000.00)Pay AP Invoice due to Company A from Company B

Create Payment for invoice created to Company A

Debit – Accounts Payable 20000-400-0000 $1000.00

Credit – Cash 10000-400-0000 ($1000.00)As you can see I am hitting the Accounts Payable twice on the Credit side which has me out of balance.

Any ideas here?

Thank you,

——————————

Tammy Chavez

Senior Software Consultant

LightHouse Business Information Solutions, LLC.

Albuquerque NM

——————————

——————————————- -

Hello Tammy,

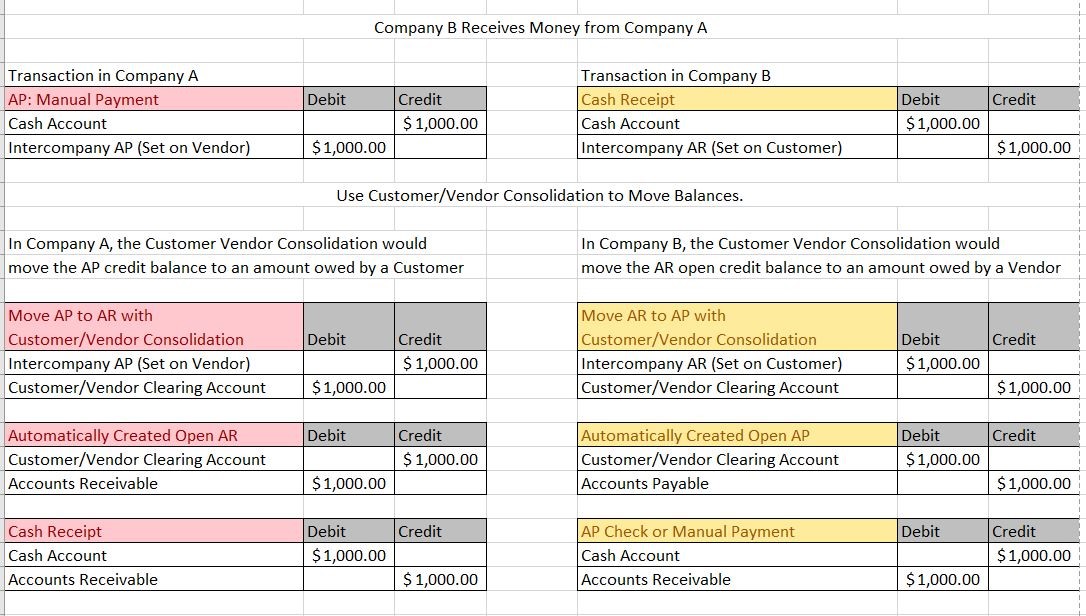

I had an idea to use the Customer/Vendor Consolidation functionality to move these balances. You could setup a customer and Vendor for each Company in the main company (Company A) and then setup Company A as a Customer and a vendor in each of the LLC’s that are getting funding.

I figured out the distributions (see attached for an Excel Version)

Let me know what you think. I wrote up a Tech Tip on setting up Customer Vendor Consolidations. You would just be using it for these specific Vendors and Customers.

——————————

Amber Bell

Training Dynamo LLC

Email: amber@trainingdynamo.com

Website: http://www.trainingdynamo.com

Twitter: @trainingdynamo

——————————

——————————————- -

Hi Amber,

Unfortunately I can’t get the attachment to open. Can you email me at tchavez@lhbis.com?

Thank you very much.

——————————

Tammy Chavez

Senior Software Consultant

LightHouse Business Information Solutions, LLC.

Albuquerque NM

——————————

——————————————- -

Hi Kathy,

I emailed the attachment to you. I am not sure why the attachment isn’t working.

——————————

Amber Bell

Training Dynamo LLC

Email: amber@trainingdynamo.com

Website: http://www.trainingdynamo.com

Twitter: @trainingdynamo

——————————

——————————————- -

I wanted to add an idea I emailed directly to Tammy. She said the volume of the transactions was too big to rely on using the Customer/Vendor Consolidations. She had an integration built that could apply open AR and open AP so I refer to that below. If you were going to implement this, you would need to apply the documents manually or build an integration too:

If you can apply with the map you built…you would just import all the transactions the Customer/Vendor consolidation automates (with the same GL accounts)

- Import Manual Payment into Origin Company: Vendor = LLC’s (I would setup the LLC’s with a special AP account. That way you can track the open AP separately. Also, I would put them in a class like “ZZZ-INTERCOMPANY”) so that they can be excluded from Aging Reports (if you have other vendors in classes…it would work).

- Import Cash Receipt in Destination Company: Customer = Origin Company (I would setup a Customer with a Vendor ID/Class ID “ZZZ-CORPORATE”. I would also use a special AR account (set as default on the customer).

- Each LLC needs this customer.

- Keeping AR in a separate account will help you balance the AR to the GL later.

- When everything is paid (Transactions in Origin Company):

- Import AP Transaction (I’d pick Misc Charge so that I could exclude if someone wants “Total AP invoices for the year”)

- Apply AP Manual Payment to the new AP Misc Charge

- In same company: Import AR Debit Memo

- In same company: Create Cash Receipt (this is the real payback from the LLC’s). Post and do Bank Deposit to update the GL and Checkbook.

- When LLC pays corporate (Transactions in Destination Company)

- Import AR Debit memo (This is to zero out balance in AR special account).

- Apply Cash Receipt to new Debit Memo

- Import AP Misc Charge (to Create open AP)

- Pay Corporate back manually with a check or with other payment method using Manual Payment window.

As I was writing that…I thought of another option:

- Import Manual Payment into Origin Company: Vendor = LLC’s (I would setup the LLC’s with a special AP account. That way you can track the open AP separately. Also, I would put them in a class like “ZZZ-INTERCOMPANY”) so that they can be excluded from Aging Reports (if you have other vendors in classes…it would work).

- Import Cash Receipt in Destination Company: Customer = Origin Company (I would setup a Customer with a Vendor ID/Class ID “ZZZ-CORPORATE”. I would also use a special AR account (set as default on the customer).

- Each LLC needs this customer.

- Keeping AR in a separate account will help you balance the AR to the GL later.

- When everything is paid (Transactions in Origin Company):

- Import AP Transaction (I’d pick Misc Charge so that I could exclude if someone wants “Total AP invoices for the year”) USE A DUE TO/DUE FROM ACCOUNT

- Apply AP Manual Payment to the new AP Misc Charge

- When LLC pays corporate (Transactions in Destination Company)

- Import AR Debit memo (This is to zero out balance in AR special account). USE A DUE TO/DUE FROM ACCOUNT

- Apply Cash Receipt to new Debit Memo

Skip the last step to move from AP to AR….after you import the Misc Charge and Debit Memo, you will have cleared AP and AR (yay!!) just do your Bank Transactions import at that step (in both companies) and use the offset USE DUE TO/DUE FROM used for the Debit Memo and Misc Charge!

——————————

Amber Bell

Training Dynamo LLC

Email: amber@trainingdynamo.com

Website: http://www.trainingdynamo.com

Twitter: @trainingdynamo

——————————

——————————————- -

I just wanted to say that the Solution Amber provided will work great! Thank you Amber for your help!

——————————

Tammy Chavez

Senior Software Consultant

LightHouse Business Information Solutions, LLC.

Albuquerque NM

——————————

——————————————-

Unknown Member replied 8 years, 6 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Sales Invoicing Scenario’ is closed to new replies.