Returned Check Not Appearing in Bank Rec Module

-

Returned Check Not Appearing in Bank Rec Module

Posted by DSC Communities on July 5, 2017 at 12:34 pm-

Tiffany Ziegler

MemberJuly 5, 2017 at 12:34 PM

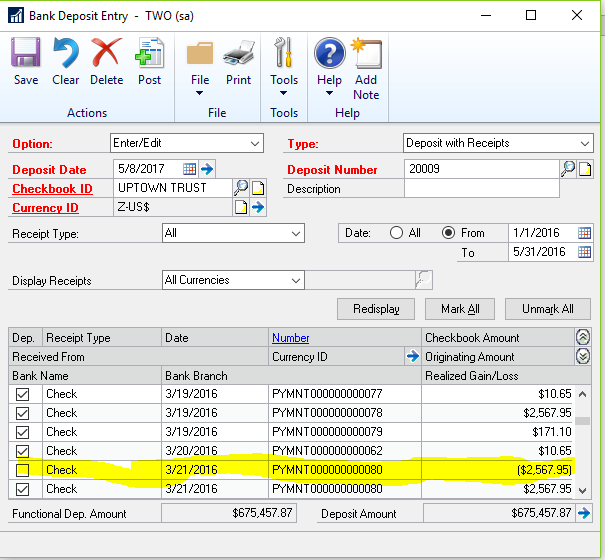

All –I have a check that we deposited on 5/30. On 6/1, the check was returned and the amount debited from our account. I went to Sales/Posted Transactions to process an NSF void. I used the 6/1 date as the void date and the posted date, since I’ve already reconciled the May bank statement. Now, the unpaid invoice appears in the customer’s account as it should, but the amount is not showing anywhere in my Bank Reconciliation module (or in my Deposits screen so that I can push it through to Bank Rec), so that I can reconcile my bank statement. I know I’ve done this before without issue, although maybe the transactions did not cross over two different months. What am I doing wrong and how do I get the debit to appear in my bank rec screen? I’ve attached the posting report from the NSF if that helps.

——————————

Tiffany Ziegler

Vice President & Controller

Velcor Leasing Corporation

Madison WI

—————————— -

Windi Epperson

MemberJuly 6, 2017 at 10:51 AM

Tiffany,

You may need to make a backup and run file maintenance. As you said, the voided check info should show in the deposit window for you to lump in with other deposits. If you have no date restriction set then it should show.Any chance you have a test company that is a copy of the live company and has this transaction in it? If so, I would repeat the void in the test company and see if you get all the same posting reports etc. My thought is that you need to trace this transaction through to completion. If it updated AR properly, but didn’t make it to Bank Rec, did it make it to GL?

In the end, if it updated everything but Bank Rec, then you’ll have to create a dummy bank transaction to use for reconciliation. What you code that transaction to will depend on if the original trx hit the GL. If it did hit GL, then you’ll do a decrease adjustment and code debit & credit to cash.

Hope that gets you started.

Thanks

Windi——————————

Windi Epperson

President/GP Senior Consultant

Advanced Integrators, Inc.

Norman OK

405-946-1774 Ext 102

——————————

——————————————- -

Leslie Vail

MemberJuly 7, 2017 at 4:26 PM

?Hi,

I’m just trying to understand to see if I can recreate the problem.

1. You received a check from your customer and recorded a cash receipt and applied it to the invoice.

2. You Deposited the check to your checking account (Deposit with receipt)

3. You reconciled your checkbook and left the above check unreconciled

4. You did an NSF on the check you received from your client.The results of the above when you do your next reconcile should be

1. The original unreconciled bank deposit

2. A WDL transaction for the amount of the NSF

You would not have a ‘negative’ deposit amount nor a negative payment.Does that describe what was done? If I understand it correctly, you are showing the unreconciled deposit, but you do not have a WDL transaction for the NSF check.

Kind regards,

Leslie——————————

Leslie Vail

Accounting Systems Consulting, Inc.

Dallas TX

——————————

——————————————- -

Tiffany Ziegler

MemberJuly 10, 2017 at 10:48 AM

Leslie –A few clarifications. I did reconcile the check in my May Bank Reconciliation module, as the bank originally marked it ‘cleared.’ (This occurred at the end of May). The check must have gone through some sort of audit process wherein the bank determined it could not indeed be deposited and returned the check in June. In doing so, they debited our account for the amount of the check.

So, as I always do in these instances, I voided the cash receipt via the Sales Posted Transactions window. I used the June dates as my void date and entry date. Generally after I do this, the negative deposit appears in the deposit screen but this is not the case. Because of this, it is also not appearing on my bank reconciliation module, so that I can now account for the debit to our bank account in early June.

Hope this helps clarify!

——————————

Tiffany Ziegler

Vice President & Controller

Velcor Leasing Corporation

Madison WI

——————————

——————————————- -

,

Not sure why the voided check did not show up in the receipts list. But to get around this you can create a deposit without receipts in the instance to get the deposit onto the bank reconciliation. If I remember right you stated that the g/l is correct.

In the future instead of voiding the cash receipt I would use the NSF functionality. If you do not want an NSF amount setup you can change it to zero. If I recall correctly this will create the bank reconciliation entry at the same time and you would not need to do a bank deposit on the transaction.

——————————

Bert Green

GP Developer/GP Administrator

Berger Transfer & Storage, Inc.

Saint Paul MN

GP2015/MR CU11

——————————

——————————————- -

Tiffany Ziegler

MemberJuly 11, 2017 at 11:13 AM

I actually did use the NSF functionality – I’ve used it in the past and it worked great. Who knows what happened this time. I’ll probably end up doing the deposit without receipts, as you suggested.——————————

Tiffany Ziegler

Vice President & Controller

Velcor Leasing Corporation

Madison WI

——————————

——————————————- -

Jutta Ipsen

MemberNovember 10, 2017 at 7:39 PM

Hello,

have you found a solution for this issue? I run into exactly the same situation . Normally after using the NFS function for the check, the amount (negative value) would show in the Bank Deposits screen . Currently the Amount showing in the Deposit screen is $0 instead of the negative $ amount.

Steps :

1. Check from your customer recorded and applied to the invoice.

2. Deposited the check to your checking account (Deposit with receipt)

3. NFS CheckNormally after this step the negative deposit appears in the deposit screen but this is no longer working the amount showing in the deposit screen is $0.

——————————

Jutta Ipsen

Baystream Corporation

Montreal QC

——————————

——————————————-

DSC Communities replied 8 years, 2 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Returned Check Not Appearing in Bank Rec Module’ is closed to new replies.