Payroll Detail Register

-

Payroll Detail Register

Posted by DSC Communities on December 4, 2017 at 2:10 pm-

Anju Ahluwalia

MemberDecember 4, 2017 at 2:10 PM

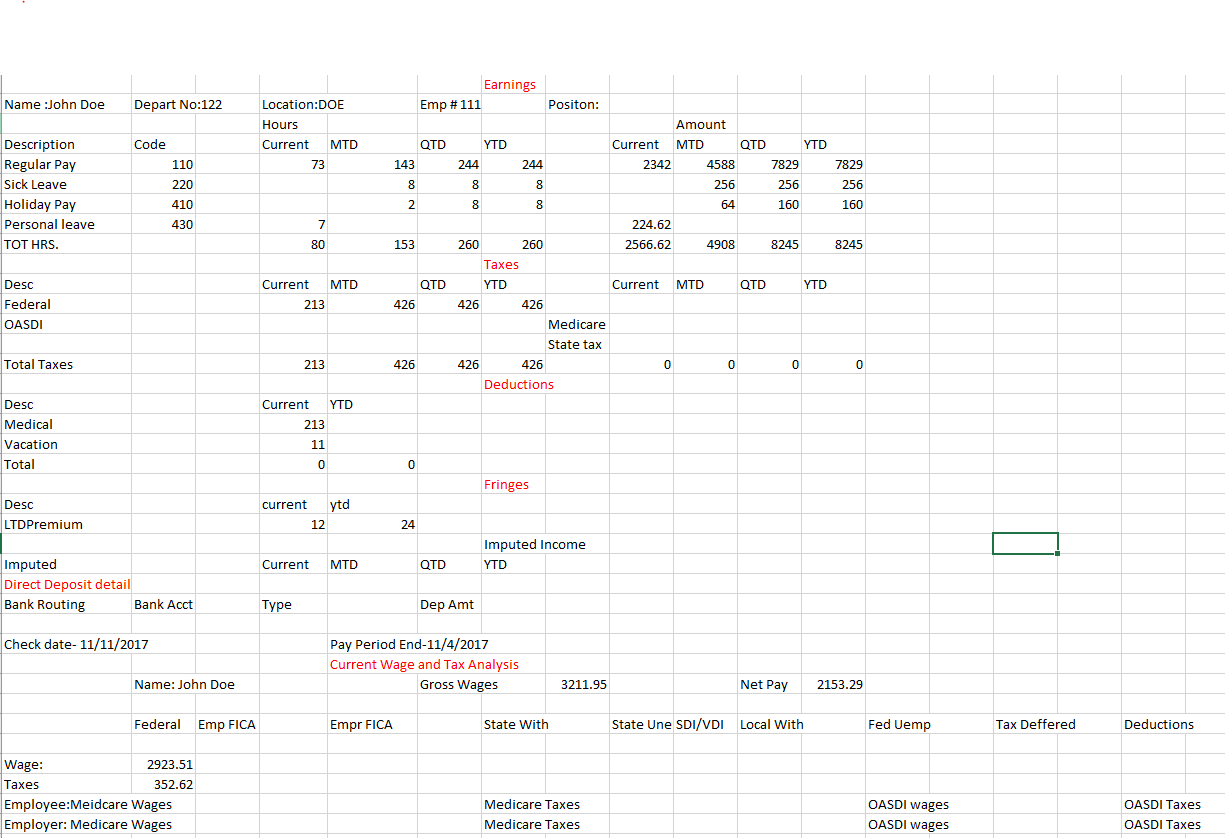

?We are currently using GP 2016 R2. I am new to GP and trying to find a Payroll register (in Detail) report in GP. I am looking for a combination of a couple of reports eg. The payroll pre-check register which shows detail for the payroll for each employee (Earnings, gross, taxes, deductions, Benefits, net) combined with the payroll register which shows total deductions for the pay run by deduction code, and the payroll summary report which show the check # for the individual.

It would be great to see the detail for each person with the check # and then at the bottom of the report a total with pay, tax, total deduction by deduction code and net.

Does anyone know of a report like this in Dynamics GP or have any of you developed a report like this in SRSS.

Thanks for all your assistance.

?

——————————

Anju Ahluwalia

Muscatine Power & Water

Muscatine IA

—————————— -

Charles Allen

MemberDecember 4, 2017 at 6:53 PM

?There is no standard report with all this information.The data is there, of course.

If you needed it, I would look into creating it using SSRS.

The report would probably be fairly straightforward to build.

——————————

Charles Allen

Senior Managing Consultant

BKD Technologies

Houston, TX

——————————

——————————————- -

Leslie Vail

MemberDecember 4, 2017 at 10:33 PM

Hi,

Could you rough out what you want the report to look like? You can just draw it on a sheet of paper, but I can’t tell for sure what you’re looking for.

Is it anything like this:

Jane Doe |check number |check date| Gross Pay by pay code | Deduction by deduction code | FICA/M withheld | Federal Tax Withheld |Net pay|employer’s FICA/M | FUTA | SUTA | Worker’s comp | etc..

Do you want to be able to calculate the total amount for this employee that would go on the 941?

Kind regards,

Leslie——————————

Leslie Vail

Accounting Systems Consulting, Inc.

Dallas TX

leslievail@earthlink.net 972-814-8550

——————————

——————————————- -

Anju Ahluwalia

MemberDecember 6, 2017 at 3:00 PM

-

Based on that layout and information displayed as Charles points out your going to need to write your own as one doesn’t exist out of the box for GP in that format. A couple of noteworthy items:

1) you will not be able to write this type of report using GP Report Writer (or at least if you do it will be very painful to do so)

2) recommendation is to use SSRS, Crystal or some other tool

3) primary tables that you’ll need in GP are: UPR00100 Employee Master, UPR30100 Check Header, UPR30300 Check Detail, UPR00400 – Employee Pay Code Master, UPR00500 – Employee Deduction Master, UPR00600 – Employee Benefit Master. You will probably need the Actual Setup tables for Pay Codes, Deductions and Benefits in order to get the actual description on your report (check out Victoria’s table guide if your not familiar with the GP data tables)

4) you will need to create calculated fields for your MTD, QTY and YTD values as their are tables that store some of this information for MTD it would be safer to calculate since you intend to run this report at various times throughout the year and your MTD amount will very based on the Date. Basically what I’m trying to say here is don’t plan on using the summary tables in GP to retrieve MTD, QTY and/or YTD values for any of these codes (they do exist in some tables), this is because if you want a check report as of 11/15/2017 and you pull the MTD value from a GP table it will contain a total that includes checks from 11/16 – 11/30, hence calculate these amounts dynamically based on your report design.Keep in mind on your report you will want to verify if the check has been voided or not (there is a void status column in the check header table).

Happy report writing,

——————————

Wally Dodds

Dorado Solutions

West Chester PA

——————————

——————————————-

DSC Communities replied 7 years, 9 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Payroll Detail Register’ is closed to new replies.