No tax on shipping charge per state

-

No tax on shipping charge per state

Posted by DSC Communities on January 7, 2019 at 9:01 am-

Robert Harriman

MemberJanuary 7, 2019 at 9:01 AM

Hello All,Is there a quick and easy way to set up a state to not calculate tax on shipping charges? For example, If I sell an item to a customer in Massachusetts and charge a fee to ship it to them, I want the system to calculate tax on the item only, not the shipping charge. I know I can manually make this happen but we want the system to do the leg work, otherwise it’s open to human error.

Many Thanks

Rob

——————————

Robert Harriman

The Eastwood Company

Pottstown PA

—————————— -

Rob,

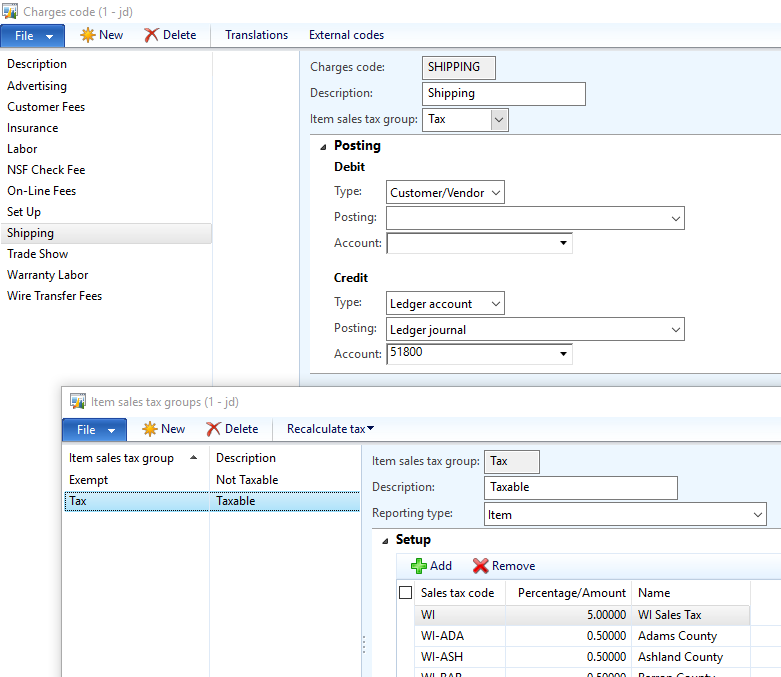

What version of AX are you on? We are on AX 2012 R2. Do you use Charges for shipping? If so, I think you could deal with this through an item sales tax group. Set up a group for taxable shipping, then assign all of the applicable sales tax codes to that group.

——————————

Amy Axness

Controller

J&D Manufacturing

Eau Claire WI

——————————

——————————————- -

Robert Harriman

MemberJanuary 9, 2019 at 8:17 AM

Hello Amy,We are using AX 2012 R3, sorry for missing that part. I was playing around with that after posting this too. We want to charge tax for product only, not shipping charges and only for certain states.

Many thanks for your reply.

Rob

——————————

Robert Harriman

The Eastwood Company

Pottstown PA

——————————

——————————————- -

You achieve that by a combination of selecting “Sales Tax Group” and “Item Sales Tax Group”.

In a highly simplified way to explain –

– you can create a sales tax group for each state. and assign to each customer record, so when creating a sales order, this will default into the sales order header and lines.– groups for states that charge tax will include sales tax code for Tax 4% (for example). groups for states with no tax will be empty.

– then you create an item sales tax group for ITEMS (which include the above Tax 4% code – you assign that group to all your items, so it will default into sales order line.

– you also create sales tax group for CHARGE which is empty, and configure the charge with it.

this way – for a “taxable” state, items will be charged with tax (and charges not)

for “non taxable: state, items and charges will not be charged with tax.——————————

Zvika Rimalt

Functional Consultant

Vancouver BC

——————————

——————————————- -

Richard Wu

MemberJanuary 11, 2019 at 7:15 AM

We’ve set ours up to only tax based on the delivery address whether or not the customer belongs to that state. We only have to deal with one state for tax, so it might need to be modified for more than one state. To do that, we set up Sales and Marketing > Setup > Distribution > Terms of delivery with Sales tax address set to “Delivery”. We’ve got the sales tax groups set with “Designate default criteria” as the particular state/country combination needed. The customer is set of with Terms of Delivery and no default sales tax group.I think everything else is as stated in previous posts (Item Sales Tax Groups, etc. need to be set).

——————————

Richard Wu

Bicon, LLC

Boston MA

——————————

——————————————- -

Mark Prouty

MemberJanuary 11, 2019 at 10:27 AM

has the right approach. Create an Item tax group (I called mine “Shipping”) and assign state tax codes as needed, except for CA. Assign this Item tax group to the Misc charge code for freight/ shipping. Note that the Misc charge code will also be applied in the Shipping Carrier interface ??Carrier company.

We almost always bill freight using the Misc Charge code, but we also have an item called “Freight” that we assign the “Shipping” item tax group to. All other items use a different Item tax group.——————————

Mark Prouty

Programmer / Analyst

ANGI Energy Systems

Janesville WI

——————————

——————————————-

DSC Communities replied 6 years, 8 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘No tax on shipping charge per state’ is closed to new replies.