Paying Credit Invoices

-

Paying Credit Invoices

Posted by DSC Communities on November 10, 2017 at 8:27 am-

Anthony Kramer

MemberNovember 10, 2017 at 8:27 AM

Hello. My company is very new to NAV. One thing we are having trouble with is paying credit invoices. We know how to apply credit invoices against other invoices, but we are wondering if there is an easier way to deal with these transactions. Some credit invoices we receive are not necessarily applicable to another invoice, they are simply credits.What other methods is anyone using to handle these?

——————————

Anthony Kramer

BelleHarvest Sales, Inc.

Belding MI

—————————— -

Cynthia Priebe

MemberNovember 10, 2017 at 10:26 AM

If you are referencing Purchase Payables, how item related credits are handled will depend on your setup and internal controls. For example, will you be using Return Orders for

product back to the vendor? Does the warehouse do an item journal adjustment for damaged items because they are not returned and you record the credit from the vendor posting an amount only to a GL Account?My first recommendation is to discuss this with your partner or the consultant that assisted with your implementation. As you can see in what follows, there are a quite few ways to go about creating, posting and applying credit memos. What I have listed here is just the start of what needs to be considered before deciding on the best process, there is more! With NAV, you can:

1) Use Copy Document from the original invoice when creating the Credit Memo if some or all of the lines are a direct reversal. When posted, the credit will automatically be applied to the source document. This may not make sense if the invoice is already paid in full.

2) From Credit Memo Lines, use the function Get Return Shipments to populate the lines. Manually apply the credit memo to the related invoices, any invoice, or keep in the ledger until you decide to apply it.

3) Create Credit Memo using GL account. Manually apply the credit memo to the related invoices, any invoice, or keep in the ledger until you decide to apply it.

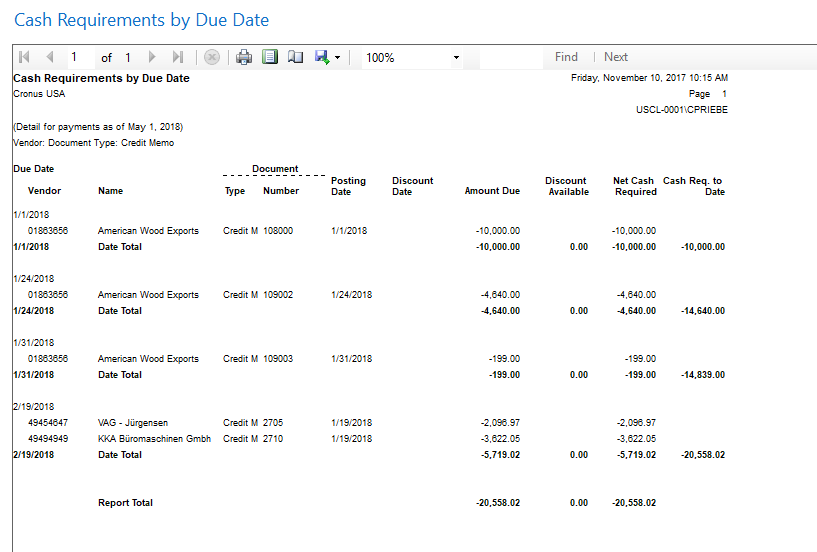

4) Use the Cash Requirements by Due Date report (print detail) to see open Credit Memos. You can include all document types, or filter to Credit Memos.

5) Use Payment Journal and Suggest Vendor Payments, summarize by Vendor. Credit Memos and Invoices will be suggested and can be paid using this method. *Caution, depending on your version, there have been bugs with posting and voiding these checks, so unless your vendor needs to see the Credit Memos taken on the check stub or in the ACH detail, I do not typically recommend this method.

——————————

Cynthia Priebe, MCTS, DCP

Senior Business Analyst and Project Manager

Liberty Grove Software

Grafton OH

——————————

——————————————- -

Aaron Brown

MemberNovember 10, 2017 at 3:09 PM

Anthony,You can generate a payment for a customer credit on the payment journal using document type “Refund” and account type “Customer”.

A word of caution: This procedure posts correctly to the customer/check ledgers and prints a valid check, but the remittance information on the check doesn’t work out of the box–at least in NAV 2015. Ours print with a (seemingly) random vendor number.

Thanks,

Aaron——————————

Aaron Brown

Director of Finance

Oregon Ice Cream

Camas WA

——————————

——————————————-

DSC Communities replied 7 years, 10 months ago 1 Member · 0 Replies -

-

0 Replies

Sorry, there were no replies found.

The discussion ‘Paying Credit Invoices’ is closed to new replies.