Add Fixed Asset with LTD Depreciation

-

Add Fixed Asset with LTD Depreciation

Hello!

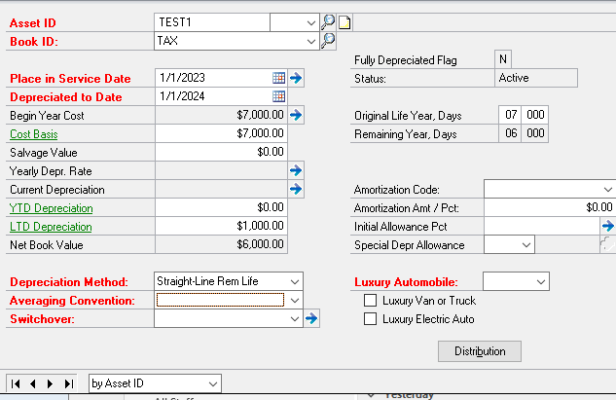

My company needs to add an asset that was technically placed in service in a prior period. Up to this point, we have manually calculated depreciation and posted straight to the GL. Now we want to add the asset to the fixed asset module, but want to make sure we account for the depreciation that has already occurred.

Most of the research I’ve found is centered around updating the depreciation sensitive fields of an existing asset. When adding a new asset, is it as simple as updating the LTD Depreciation field on the asset book window? In my example below, will GP properly calculate depreciation based on the remaining NBV of $6,000 when running depreciation through the fixed asset module? Also, what will be the effect on the GL of manually adding the $1,000 of LTD Depreciation?

Thank you!

Andrew

Log in to reply.