Decimal places for Unit/Standard cost

-

Decimal places for Unit/Standard cost

I am having a little trouble understanding the number of decimal places for unit cost/standard cost in BC.

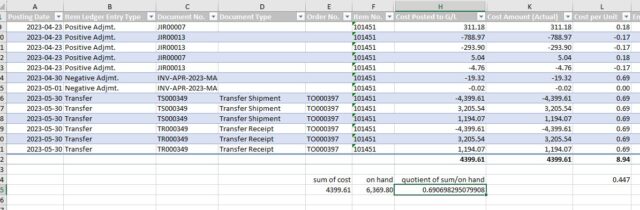

I have an item that has a unit cost of 0.69$ but when I print the Inventory Valuation report I get a value that does not reflect a 2 decimal place number.6,369.80 * .69 <> 4,399.61

It is 6,369.80 *0.690698295079908 that = 4,399.61 and I can see this when I send the same report to Excel

So what is my standard/unit cost? I did a standard cost roll-up and it was for 0.69$.

At least I thought I did, but was it really for .690698295079908.

I can change the on the Gen Ledger Setup to 2:5 so that I get more decimal places to show on the inv val report, but it still isn’t 100% true. And it doesn’t change the Unit Cost on the Item Card, it stays 0.69.

So what is my standard cost .69 or 690698295079908?

How can I trust the Inventory Valuation Report if the Unit Cost is not correct? I guess I can assume that the Inventory Value is correct, but the Unit Cost will sometimes be an approximation. Do other users just send this to excel and reformat the cells to hold more decimal places?

Regards and Thanks

The discussion ‘Decimal places for Unit/Standard cost’ is closed to new replies.